Heard about zombie companies but not sure what they are? Then let Lucas Ross – Business rescue Recovery & Insolvency explain it to you.

Think tank onwards reported that 1-4% of businesses have become zombie companies since the coronavirus pandemic started. Bringing the estimate of total zombie businesses in the UK to more than 20%.

The pandemic took no prisoners, with chains such as Debenhams affected. Arguably this number would be much higher had the government not stepped in but we still seen a large amount of businesses struggling and closing closing due to the unprecedented conditions.

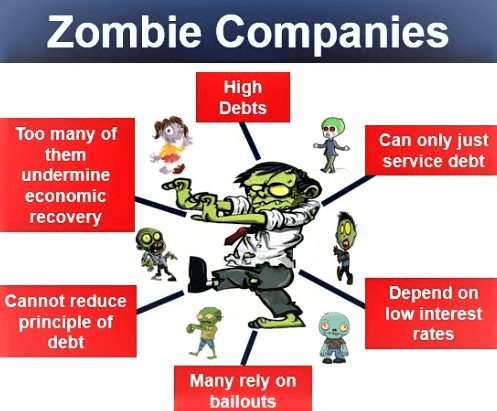

Zombie companies, are companies that are continuously in debt, this could mean the company has enough cash flow to afford to pay their fixed costs such as rent and employees but majority of the time can only afford to pay the interest on their debts but cant actually afford to pay off the debt entirely, as they have virtually no excess capital after paying their main responsibilities.

There are very limited benefits from owning or having dealings with a zombie company, there is however one business that would benefit from having any dealings with zombie companies, the banks. The banks are making interest on any monies owed, therefore they won’t be in any rush to write off any capital debt, as this means they would then lose out on money from the interest that’s been accumulating.

Shareholders, employees and directors don’t really get any positive effects from being involved with a zombie company, as no director wants a history of negative businesses and then there are shareholders who make their money by the business paying dividends to them, however if there is no excess money, this won’t happen and again with staff, if a business is barely getting by, this will mean no bonuses and pay rises. Therefore the employees will lose enthusiasm as they won’t be working towards anything in their career path.

Whilst these companies are still on-going but undoubtably in a difficult financial situation, reviewing your options and obtainning reputable business advice is always advised. Its easier to prevent something than to repair it after the damage has been done. A licenced and regulated insolvency practitioner can assist with this.

Therefore here at Lucas Ross – Business Rescue, Recovery & Insolvency. We have a team of specialist trained advisors that are on hand, to give impartial advice with a free, no obligatory virtual meeting. Contact us today on – Email: help@lucasross.co.uk , Freephone: 03301289489 if you need any help or support.